The markets generating heavy lift and project cargoes have proven resilient to economic and political shocks, but the global economy is certainly feeling the impacts. While not all economies will fall into recession this year, the World Bank expects headwinds to slow down almost all developed and emerging markets.

Global growth is slowing sharply in the face of elevated inflation, higher interest rates, reduced investment, and disruptions caused by Russia’s invasion of Ukraine, according to the World Bank’s latest Global Economic Prospects report.

Given fragile economic conditions, any new adverse development – such as higher-than-expected inflation, abrupt rises in interest rates to contain it, a resurgence of the Covid-19 pandemic, or escalating geopolitical tensions – could push the global economy into recession. This would mark the first time in more than 80 years that two global recessions have occurred within the same decade.

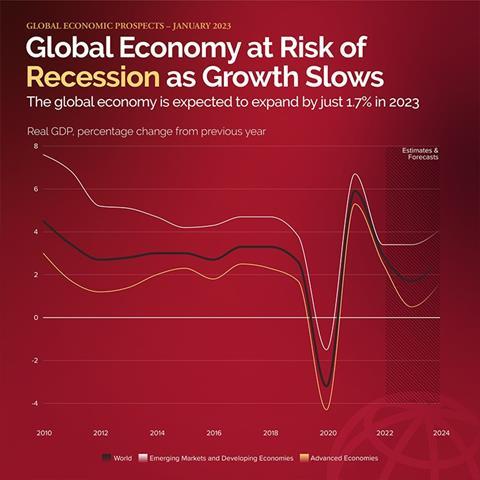

The global economy is projected to grow by 1.7 percent in 2023 and 2.7 percent in 2024. The sharp downturn in growth is expected to be widespread, with forecasts in 2023 revised down for 95 percent of advanced economies and nearly 70 percent of emerging market and developing economies, said the World Bank.

Over the next two years, per-capita income growth in emerging market and developing economies is projected to average 2.8 percent, a full percentage point lower than the 2010-2019 average. In Sub-Saharan Africa – which accounts for about 60 percent of the world’s extreme poor – growth in per capita income over 2023-24 is expected to average just 1.2 percent, a rate that could cause poverty rates to rise, not fall.

“The crisis facing development is intensifying as the global growth outlook deteriorates,” said World Bank group president David Malpass. “Emerging and developing countries are facing a multi-year period of slow growth driven by heavy debt burdens and weak investment as global capital is absorbed by advanced economies faced with extremely high government debt levels and rising interest rates. Weakness in growth and business investment will compound the already devastating reversals in education, health, poverty, and infrastructure and the increasing demands from climate change.”

Growth in advanced economies is projected to slow from 2.5 percent in 2022 to 0.5 percent in 2023. Over the past two decades, slowdowns of this scale have foreshadowed a global recession.

In the USA, growth is forecast to fall to 0.5 percent in 2023 – 1.9 percent below previous forecasts and the weakest performance outside of official recessions since 1970. In 2023, Euro-area growth is expected at zero percent – a downward revision of 1.9 percentage points. In China, growth is projected at 4.3 percent in 2023—0.9 percentage point below previous forecasts.

Excluding China, growth in emerging market and developing economies is expected to decelerate from 3.8 percent in 2022 to 2.7 percent in 2023, reflecting significantly weaker external demand compounded by high inflation, currency depreciation, tighter financing conditions, and other domestic headwinds.

By the end of 2024, GDP levels in emerging and developing economies will be roughly 6 percent below levels expected before the pandemic. Although global inflation is expected to be moderate, it will remain above pre-pandemic levels, said the World Bank.

Over the 2022-2024 period, gross investment in developed and developing economies is likely to grow by about 3.5 percent on average, less than half the rate that prevailed in the previous two decades.

“Subdued investment is a serious concern because it is associated with weak productivity and trade and dampens overall economic prospects. Without strong and sustained investment growth, it is simply impossible to make meaningful progress in achieving broader development and climate-related goals,” said Ayhan Kose, director of the World Bank’s Prospects Group. “National policies to boost investment growth need to be tailored to country circumstances but they always start with establishing sound fiscal and monetary policy frameworks and undertaking comprehensive reforms in the investment climate.”

The Global Economic Prospects report also shed light on the dilemma of 37 small states with a population of 1.5 million or less. These states suffered a sharper Covid-19 recession and a much weaker rebound than other economies, partly because of prolonged disruptions to tourism.

In 2020, economic output in small states fell by more than 11 percent – seven times the decline in other emerging and developing economies. The report finds that small states often experience disaster-related losses that average roughly 5 percent of GDP per year. This creates severe obstacles to economic development. The bank said policymakers in small states can improve long-term growth prospects by bolstering resilience to climate change, fostering effective economic diversification, and improving government efficiency.