Sector analyst Veson Nautical identifies challenging market conditions ahead for the PCTC segment, should potential USTR port fees of USD1 million per voyage for non-US built car carriers enter force from mid-October. Combined with this week’s signals from Washington suggesting a sooner-than-expected reopening of the Red Sea, car carrier demand could take a heavy blow.

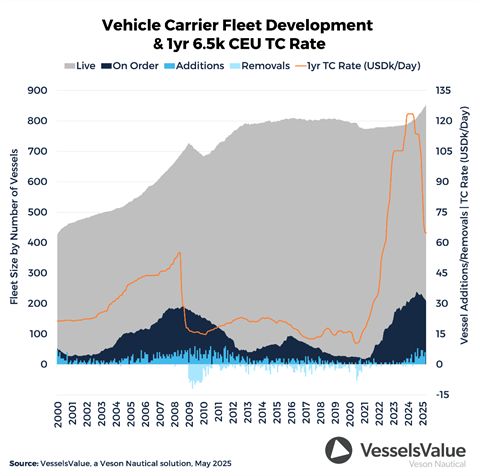

Dan Nash, associate director, valuation and analytics at Veson Nautical, also highlighted supply growth that is expected to be in positive double-digit territory over the same period, suggesting an accelerated correction in both time charter rates and asset values, with levels likely reverting towards long-term historical averages.

“A major scrapping phase – reminiscent of 2009 – is likely to follow, as history often rhymes. Red lights have started flashing in this sector, but for now, the global economy remains at amber,” he warned.

After years of tight capacity and record-high rates, the global ro-ro shipping market is entering a new phase marked by rising vessel deliveries, growing competition, and weakening demand – particularly EVs. This, perhaps, bodes well for those looking to the mode for high and heavy shipments, which have been less of a priority for ro-ro lines in recent years.

In its April 2025 trade update, Höegh Autoliners transported 1.2 million cu m of cargo on prorated basis during the month. High and heavy/ breakbulk’s share of prorated volumes carried in that month was 21 percent – a slight increase over the Q1 average of 19 percent.