Danish energy company Ørsted has approved a business plan that will see it exit several offshore markets, including Norway, Spain and Portugal, and cut up to 800 jobs.

2023 marked a year with substantial challenges for Ørsted as its US offshore projects caused significant impairments and additional costs. The developer has since conducted an extensive review of its project portfolio. The measures for its updated business plan are an attempt to reduce risks and ensure a robust balance sheet, the company explained.

“We have prioritised projects within our portfolio and are implementing significant changes in our business, including revising our operating model to reduce risks,” said Mads Nipper, group president and ceo. “We now present a robust business plan, and with an uncompromising focus on value creation, we plan to more than double our current installed capacity of renewable energy by 2030.”

As previously reported, Ørsted ceased the development of the offshore wind projects Ocean Wind 1 and Ocean Wind 2 and will primarily focus its US offshore portfolio towards the North-East Atlantic. The company will also exit the Norwegian, Spanish and Portuguese markets, while deprioritising development activities in Japan. Furthermore, Ørsted will accelerate its divestment programme.

Measures to become “a leaner and more efficient organisation” will aim to reduce fixed costs by DKK1 billion (USD150 million) by 2026 compared to 2023. This will include a reduction of 600-800 positions globally. Redundancies are expected throughout 2024, and Ørsted said that approximately 250 people will leave the company in the coming months.

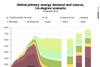

It will be of little surprise that the company’s plans installed renewable capacity targets are reduced – down from 50 GW by 2030 to 35-38 GW. This will still be more than double the company’s current installed capacity of around 15.7 GW, however. In the near-term, Ørsted expects to have an installed capacity of approximately 23 GW by 2026.

Ørsted is not the only energy company facing a challenging offshore wind market. Research from Westwood Global Energy Group indicates that out of the 380 GW of pre-sanctioned offshore wind capacity that is forecast to reach FID between 2024 and 2030, nearly 40 percent of the pipeline is considered “risked”.

Its Projects Certainty White Paper said that developers such as TotalEnergies and BP have the highest risk profiles, with substantial pipelines but limited or no operational capacity, compared to Ørsted and RWE with sizeable track records and a less ‘risked’ unsanctioned portfolio.

Bahzad Ayoub, senior analyst – offshore wind, Westwood said: “Offshore wind market uncertainty is rife. Growing diversity of developers in the marketplace, combined with evolving development and commercialisation approaches has created a complex landscape. This is compounded further by the diversification of the investor landscape, with oil and gas majors, public investment funds, and even fashion houses entering the sector. However, despite this uncertainty, there is significant opportunity ahead to be capitalised on, but we must first understand the risk.”

He added: “When viewed collectively, our current projections reveal a pipeline that faces sizeable risks before reaching FID, with only 9 percent of capacity ‘probable’ with the remaining 51 percent ‘possible’ and 40 percent ‘risked’.”