Shipping sector analyst Drewry said the multipurpose and heavy lift market is navigating choppy waters, driven by a convergence of global short-term shocks and long-term structural transformations. While the sector has a history of resilience, complacency is not an option.

Among the short-term risks, Drewry pointed to the Russia–Ukraine conflict, Israel–Gaza conflict, Israel–Iran tensions, China–Taiwan relations, and escalating India–Pakistan border tensions. Each of these developments has the potential to disrupt trade lanes, increase insurance premiums, and redirect cargo flows.

Moreover, the Trump administration’s policy changes and tariff decisions have created market volatility and unpredictability of trade. For instance, at the beginning of this year, the US government introduced a moratorium on new offshore wind leases; in April, it issued a stop work order on the Empire Wind offshore project before allowing construction activity (which was 30 percent complete) to resume in May. “Halting such a massive project already in development was a real shock to the industry, something without precedent, so even as development is now continuing, investment risks have increased substantially,” said Drewry.

The USA’s tariff measures have significantly impacted the steel market, with domestic hot-rolled coil prices rising from USD35 to USD47 per 100 lbs between January and April, said Drewry. This surge confused domestic auto manufacturers, causing them to reduce steel purchases. Moreover, in May, president Donald Trump threatened to slap a 50 percent tariff on EU imports, citing difficulty in negotiations. However, this was postponed until July 9 to allow further discussions.

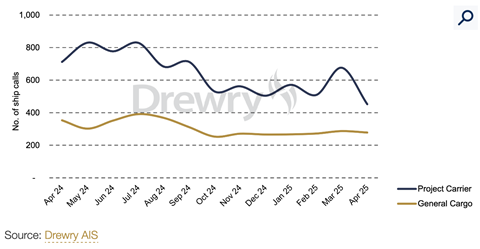

“Since the March 12 tariff implementation, port calls of project carriers have declined. Prior to this, a temporary spike in February–March reflected stockpiling, followed by a notable downturn,” said the analyst.

Long-term challenges

Longer term, selecting the ‘fuel of the future’ is one of the most complex and consequential decisions for shipowners. While alternatives like LNG, hydrogen, and ammonia are gaining attention, major challenges include limited fuel availability at secondary ports, a lack of global bunkering infrastructure, plus high costs and technological immaturity.

These problems have resulted in limited uptake by vessel operators. Out of about 7,700 vessels in the current general cargo/project carrier fleet, only 38 operate on LNG or biofuels – less than 0.5 percent – said Drewry. “Of the 620 ships on order (as of May 1), only 17 are designed for green fuels, showing a slow shift toward cleaner technologies,” said Drewry. Efficiency improvements in traditional engines and innovations (e.g. air lubrication and hull design optimisation) remain more practical in the short term. Complicating matters further are stricter decarbonisation mandates, such as the EU ETS, which are forcing multipurpose vessel operators to invest in compliant vessels without clear visibility into future regulatory pathways.

The analyst believes that a thorough understanding of both immediate threats and structural changes – especially regarding fuel choices, vessel specialisation and regulatory compliance – is essential for long-term success.

“While operators cannot influence global politics, they can control fleet strategy, adaptability, and investment timing. These factors will ultimately shape their competitiveness in the decade ahead,” said Drewry.