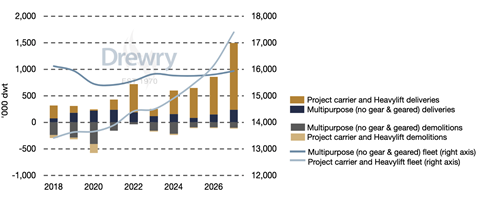

Shipping industry analyst Drewry said that it has started to see an increase in multipurpose vessel demolition activity, although levels are still low in comparison to historical averages.

Although the near future will see demolitions increase, the low orderbook indicates that the supply of vessels could tighten with growing demand, and demolition candidates will again fall. Robust demand for moving project cargo will continue to support multipurpose (MPV) shipping, enabling charter rates to remain substantially above pre-pandemic levels, in contrast with the competing sectors of dry bulk and container ships.

However, not all multipurpose ships are suitable for specialised transport, thus demolition candidate tend to be the larger types with low crane capacity – often in competition with the bulk and containers vessel operators. Smaller multipurpose vessels, project and premium project carriers will be able to find employment much easier based on Drewry’s vessel demand forecasts.

Drewry said that yearly demolitions had already reached 91,000 dwt, of which 67,000 dwt were of low crane capacity. Its expectation is for this figure to more than double by the end of 2023 and increase by a further 35 percent in 2024.

The number of demolition candidates is low by historical levels. In 2015, demolitions reached 809,000 dwt, followed by 516,000 dwt in 2016 and 552,000 dwt in 2017.

Drewry expects demolition candidates to decline again after 2024, due to low numbers of deliveries bringing a tightness in supply. In 2025, the expectation is for increase demand and vessel utilisation, which will bring an increase in time charter rates; the lack of supply will most likely result in operators still finding employment for vessels which would otherwise be sent for demolition.

The analyst also forecasts multipurpose time charter rates. Drewry’s Multipurpose Time Charter Index continued a slow decline over June and now stands at USD8,912. Last month, the daily time charter rate stood at USD8,984 per day.

Drewry anticipates that this gradual rate of decline will continue for the foreseeable future, stating that the pressure from the competing sectors of containers, ro-ro and dry bulk for breakbulk cargoes remains. The rates, it added, continue to be supported by the project market.