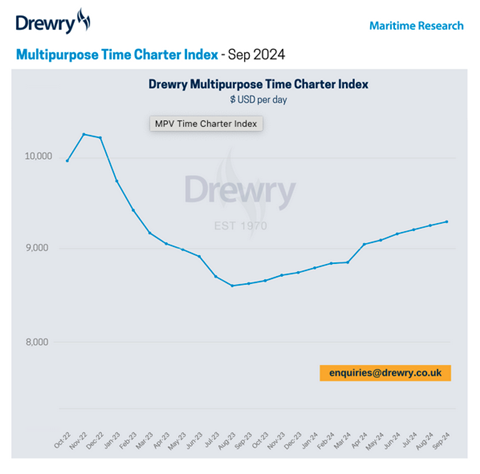

The Drewry Multipurpose Time Charter Index tracked upwards over the past month to hit USD9,259 per day at the start of September 2024.

The index was slightly above its previously predicted value of USD9,245 per day. It said that demand for larger multipurpose vessels continued to increase throughout August, while demand for smaller vessels fell slightly as the seasonal dip continued.

The index is expected to continue on its upward trajectory upwards, increasing by 0.4 percent over the coming to month to hit USD9,301 per day.

Drewry’s August Multipurpose Time Charter Index

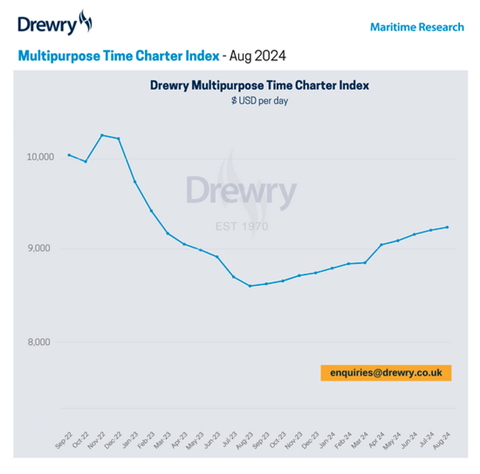

The Drewry Multipurpose Time Charter Index has continued its ascent, standing at USD9,212 per day at the start of August 2024.

The figure is slightly above its previously predicted value of USD9,201 per day. The seasonal dip for smaller vessels dampened the index increase, but demand for larger multipurpose vessels was enough to give an overall index increase, said the analyst.

Drewry’s multipurpose index is expected to continue climbing with a 0.4 percent increase in August, reaching USD9,245 per day. This would be 7.7 percent above the August 2023 figure.

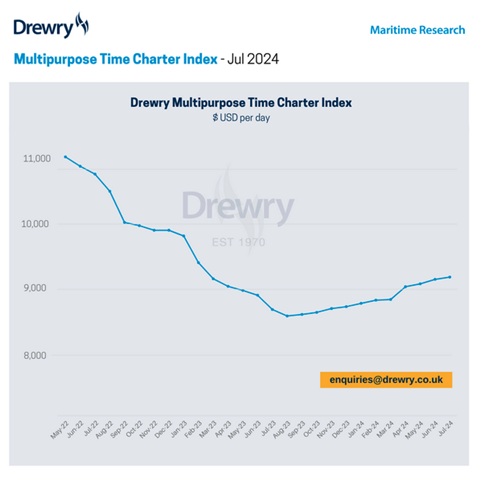

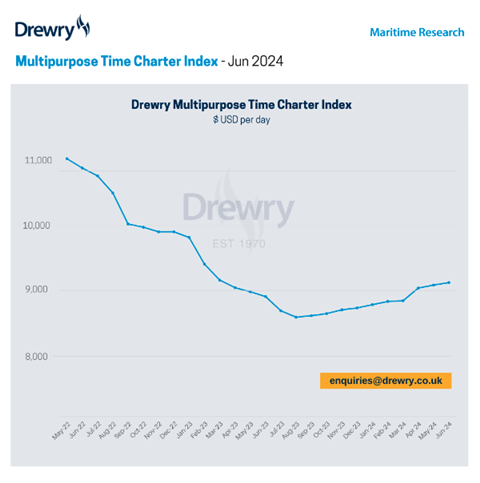

The Drewry Multipurpose Time Charter Index for the start of July 2024 stood at USD9,165 per day, up slightly over last month’s figure of USD9,094.

The latest figure was above Drewry’s previously forecasted value of USD9,04 per day. It said that smaller vessels remained stable with some seeing a small seasonal decrease. Larger multipurpose tonnage prices continued to increase over June.

The analyst expects the index to continue increasing, with an uptick of 0.4 percent over the month of July reaching USD9,201 per day. This would be 5.9 percent above the July 2023 figure.

Drewry’s June Multipurpose Time Charter Index

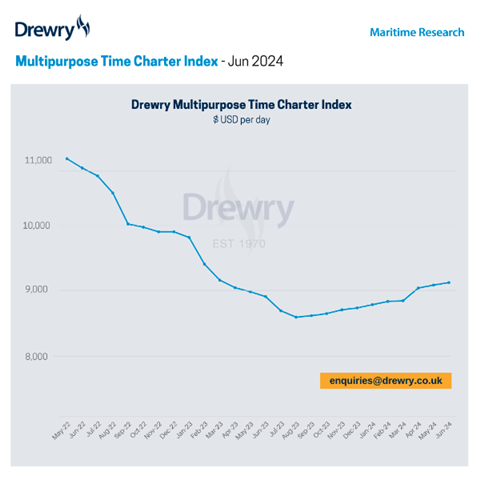

The analyst predicted that daily time charter rates for May would hit USD9,054. However, its May index settled slightly higher at USD9,094 per day. It said that rates for larger multipurpose vessels continued to increase over the month, while demand for smaller ships remained stable.

“We expect the index to continue this rate of increase in June, with Drewry’s Multipurpose Time Charter Index rising by 0.5 percent to reach USD9,136 per day. This would be 2.5 percent above the June 2023 figure,” it said.

Drewry’s May Multipurpose Time Charter Index

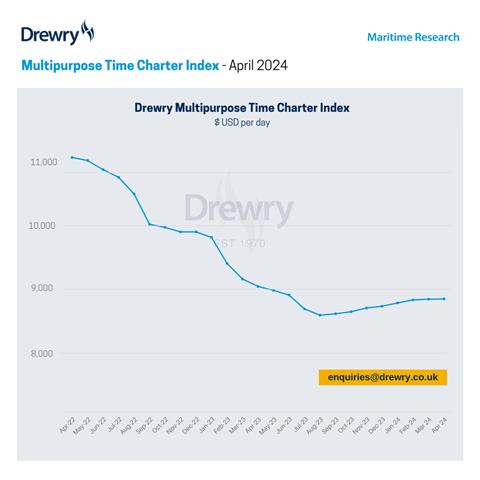

The Drewry Multipurpose Time Charter Index is tracking above the analyst’s forecasted value for April, increasing to USD9,048.

Drewry expected the index to stand at USD8,850, commenting that “the past month gave a better than expected performance for larger multipurpose vessels, leading to the larger increase”.

The analyst added: “We believe this increase is due to the additional tonne miles required as a result of the issues with both major canals. The expectation is for the index remain around this newly increased level in May, with the possibility of a small increase.”

Drewry’s April Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index is tracking below the analyst’s forecasted value for March, with little movement on the time charter rates over the past month.

Drewry expected the index to increase during March to USD8,853 per day. Instead, the figure currently stands at USD8,845 – a negligible increase on the prior months’ figure of USD8,834.

The expectation is for the index to remain around this level in April, with the possibility of a small 0.1 percent increase to reach USD8,850. This would be 2.3 percent below the April 2023 figure.

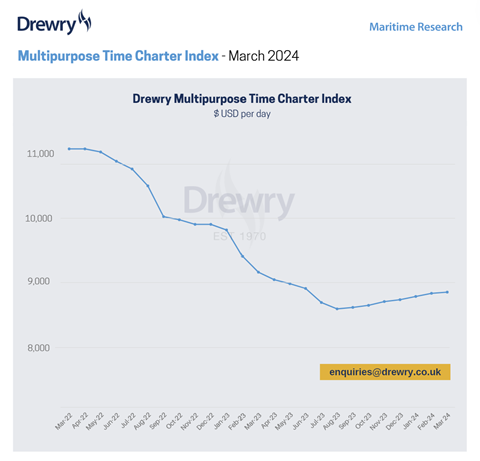

Drewry’s March Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index is tracking above the analyst’s forecasted value, with further upticks expected in over March.

Drewry expected the index to increase during February by 0.4 percent to USD8,821 per day. Instead, the figure currently stands at USD8,834.

“The ongoing Red Sea situation continues to bring increased utilisation, while smaller vessels, are also seeing a seasonal boost,” Drewry explained.

It added that its overall expectation is for the index to have a further uptick in March, albeit not at the same level as previous months. It is expected to increase by 0.2 percent over March, reaching USD8,853 per day. This would represent a decline of 3.5 percent since March 2023.

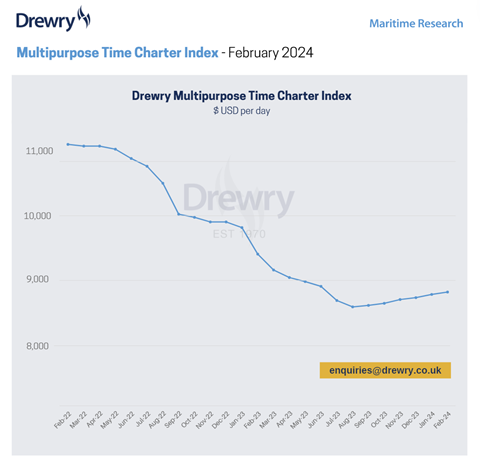

Drewry’s February Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index increased over the past month, standing at USD8,783 per day at the end of January, compared to USD8,731 per day at the end of December.

The analyst said the result is above its originally forecasted value of USD8,753 per day, adding that the situations in both the Red Sea and the Panama Canal have led to increased vessel utilisation.

Drewry explained that as a result of those factors, it expects the index to increase during February by 0.4 percent to USD8,821 per day. This would represent a year-on-year decline of 6.5 percent compared to February 2023.

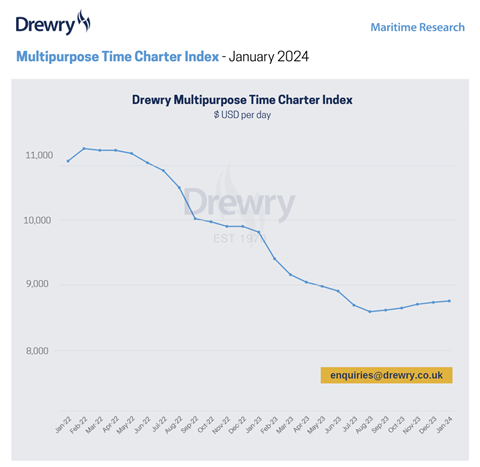

Drewry’s January Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index increased ever so slightly over the past month, standing at USD8,731 per day at the end of December 2023.

The analyst said the result is slightly below its forecasted value of USD8,734 per day; with the year closing, there was the usual rush to cover positions for the holiday period, resulting in a little fluctuation in the index.

Drewry expects the index to hover around this level for the first month of 2024, climbing 0.3 percent to USD8,753 per day. This would represent a year-on-year decline of 10.3 percent over the same period of 2023.

Drewry’s December Multipurpose Time Charter Index

![]()

The Drewry Multipurpose Time Charter Index has continued to increase over the past month, reaching USD8,701 per day.

The figure is above the analyst’s forecast of USD8,669 and it expects the index to remain around this level. As the year ends, Drewry expects a slight increase in the index as charterers aim to cover the holiday period for some multipurpose categories.

Therefore, the index is expected to increase by 0.4 percent in December, reaching USD8,734 per day. This would result in a decline of 15.7 percent since December 2022.

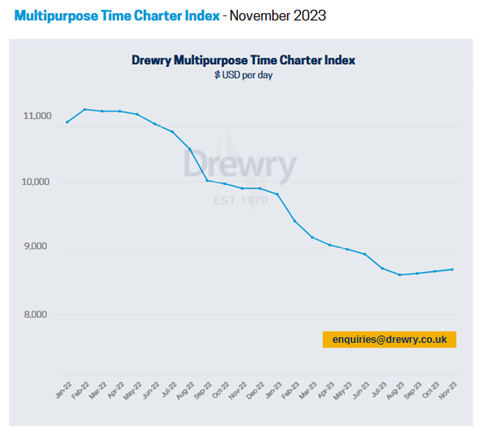

Drewry’s November Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index has crept upwards over the past month and the November figure now stands at USD8,640 per day.

The November figure is up on the analyst’s earlier forecast of USD8,634, and an increase over October’s value of USD8,607.

Entering the final months of 2023, some charterers are waiting to commit that is likely to add to a rush in some segments, again leading to another small increase in the index, said Drewry.

It expects the index to increase by 0.3 percent over November, reaching USD8,669 per day. This would represent a decline of 15.7 percent since November 2022.

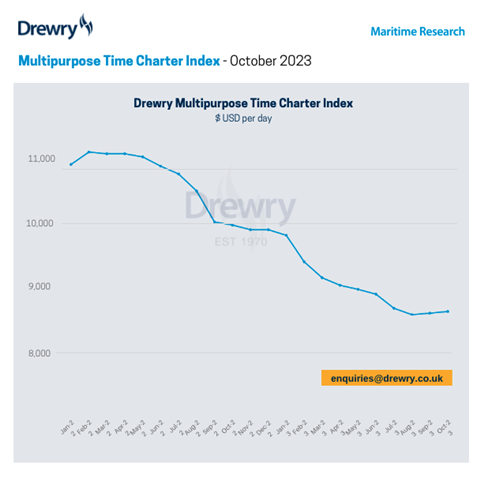

Drewry’s October Multipurpose Time Charter Index

The slight increase is due to an uptick for smaller multipurpose vessels, and Drewry’s expectation is now for a slight increase in rates.

Looking to the month ahead, the analyst said that the seasonal downturn in utilisation has ended and in combination with the continued support by the project market means rates are expected to increase by 0.3 percent.

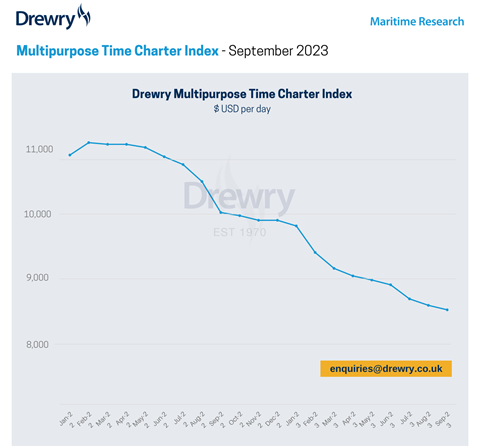

Drewry’s September Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index has a slight uptick over August’s forecast and is now tracking at USD8,583 per day. Last month, the daily time charter rate stood at USD8521.

The value is in line with Drewry’s expectation that the time charter rates will continue a gradual rate of decline. The pressure from other sectors competing for breakbulk cargoes continues to weigh on the multipurpose sector.

“The seasonal downturn in utilisation is coming to an end and the continued support by the project market means rates are expected to have less of a decline in September,” said Drewry.

Its Multipurpose Time Charter Index is expected to decline further by 0.8 percent in September, reaching USD8,511 per day. This would result in a decline of 15.4 percent since September 2022.

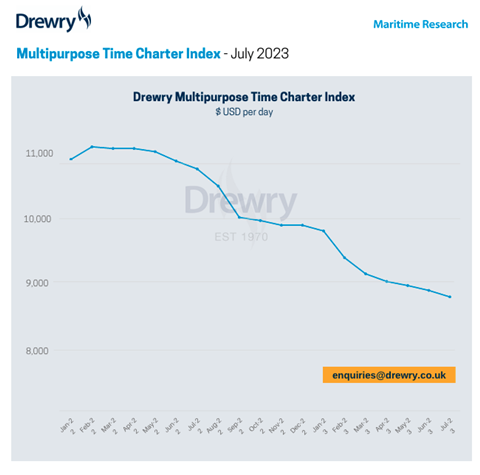

Drewry’s July Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index continued a slow decline over June and now stands at USD8,912. Last month, the daily time charter rate stood at USD8,984 per day.

Drewry anticipates that this gradual rate of decline will continue, stating that the pressure from the competing sectors of containers, ro-ro and dry bulk for breakbulk cargoes remains. The rates, it added, continue to be supported by the project market.

It noted that the Drewry’s Multipurpose Time Charter Index is expected to decline further by 1.2 percent in June, reaching USD8,809 per day. This would result in a decline of 16.95 percent since July 2022.

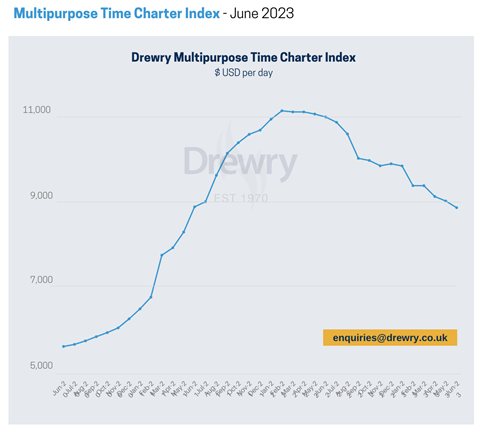

Drewry’s June Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index continued to slide in May and now stands at USD8,984. Last month, the daily time charter rate stood at USD9,069 per day.

The number is in line with Drewry’s expectations and this gradual rate of decline still expected to continue. “The competition from other sectors like containers and ro-ro for breakbulk cargoes keeps the pressure on for multipurpose vessels,” said Drewry.

The project market is helping to slow the decline and the analyst expects rates to remain above pre-covid levels. It projects another 0.8 percent decline during in June, reaching USD8,912 per day. This would result in a decline of 19.35 percent since June 2023.

Drewry’s May Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index continued to decline in April, albeit at a slower rate, and now stands at USD9,069 per day.

The drop is in line with Drewry’s expectations, and the gradual rate of decline is expected to continue. More competition from other sectors like container, ro-ro and dry bulk carriers will continue to apply pressure on multipurpose rates.

Drewry said: “Project cargoes are still seen as the underlying support for the rates and are helping to slow the decline. It remains our expectation that rates will be kept above pre-covid levels by the project sector.”

The Multipurpose Time Charter Index is expected to decline marginally by 0.9 percent in May, reaching USD8,989 per day. This would result in a 19.16 percent drop since May 2022 but would still remain 7.8 percent above the levels seen in May 2021.

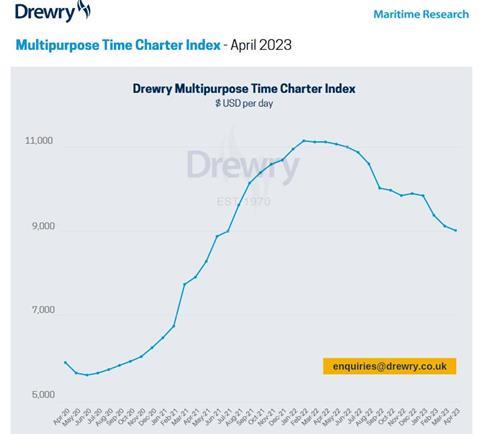

Drewry’s April Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter fell again over March, dropping to USD9,175 per day.

The drop was as expected, said Drewry, which forecasts that this gradual rate of decline is set to continue. With containers now at low levels, they have returned as competitors for breakbulk cargoes and weakening multipurpose rates.

Moving forward, Drewry anticipates that volumes of project cargoes will keep rates above pre-covid levels.

In April, Drewry’s Multipurpose Time Charter Index is expected to decline marginally by 1.1 percent to reach USD9,069 per day. This would represent a drop of 18.8 percent since April 2022, but still remains 13.9 percent above April 2021.

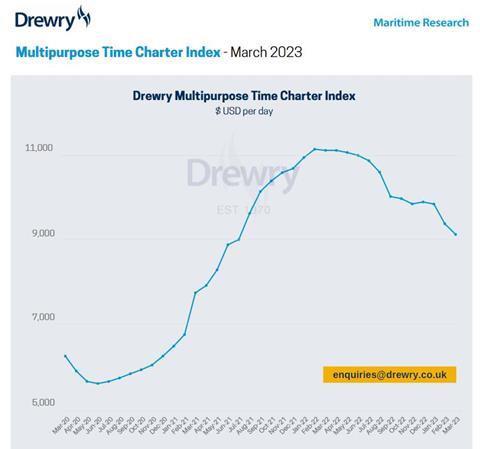

Drewry’s March Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index continued to decline over February 2023, dropping to USD9,430 per day.

“Shortsea rates which were slowing the speed at which the index fell, have seen a lack of cargoes and their rates took a dip,” Drewry explained. “This resulted in a larger reduction in the index. However, still not as bad as in other segments.”

The analyst added: “We believe various project cargoes which are suited to the multipurpose market are still supporting the rates. However, this is a fleet of many vessel types and sizes, meaning not all can take advantage of the project cargo market and may see a steeper decline.”

It believes that the charter market will remain under pressure for the remainder of the first quarter. It forecasts that the index will decline by 2.7 percent during March, reaching USD9,175 per day. This would represent a drop of around 17.8 percent compared to March 2022, but still up 17.7 percent compared to March 2021.

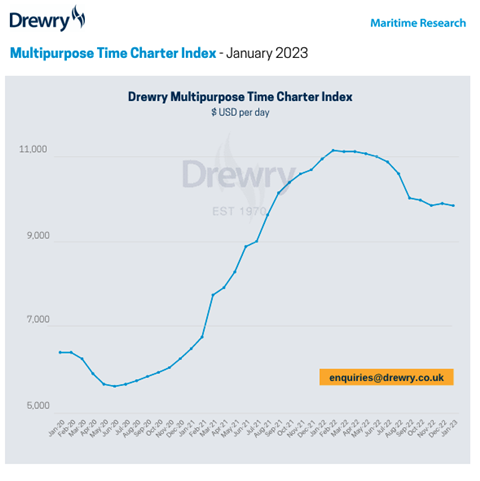

Drewry’s January Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index remained flat in December 2022, at USD9,946 per day. This was slightly above its forecast amidst the general trend of decreasing day rates in recent months.

Going forward, Drewry believes that the decline in rates will be gradual as project cargo demand will provide support in the backdrop. Cargoes that are well suited for multipurpose vessels, such as wind turbine components, will provide employment opportunities in the sector.

Nevertheless, the charter market will be under pressure at the beginning of 2023, with the index declining marginally by 0.5 percent in January, reaching USD9,896 per day. This would represent a drop of around 10 percent since January 2022, but still remains some 52 percent above January 2021.

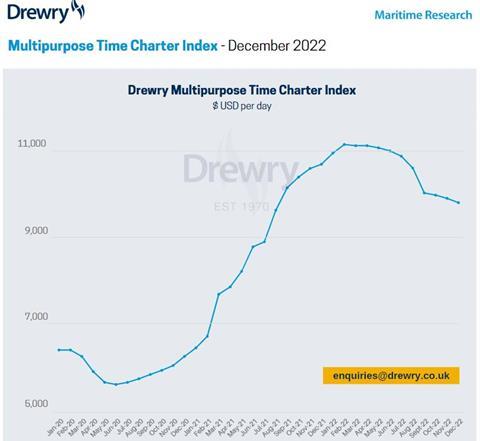

Drewry’s December Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index continued to decline over November reaching USD9,950 per day – slightly above the analyst’s forecast and 0.7 percent below October’s average rate.

Rates in the smaller shortsea sector were steadier than those for the larger vessels. Drewry expects that trend to continue to the year end as holidays in most parts of the world impact both demand and port stays, with the potential to shave a further percentage point from the index as the year closes.

The analyst added that most owners appear to be fixed over the holiday period in an attempt to mitigate any downtime in ports. “This will also support the market somewhat, as demand remains steady in most sectors, with continued growth in the project market,” said Drewry.

Going forward to over the year-end, an earlier Chinese New Year, coupled with concerns from that country regarding unrest, and the continued pressure on energy supplies in Europe, result in a weakening market outlook.

While there is little volatility in the competing sectors, Drewry anticipates that there will be further market encroachment into 2023. It therefore expects the index to fall to a forecast average of USD9,850 per day over December. This would represent a drop of around 8 percent year on year and a 10 percent drop since January 2021.

Nevertheless, that rate remains some 57 percent above December 2020.

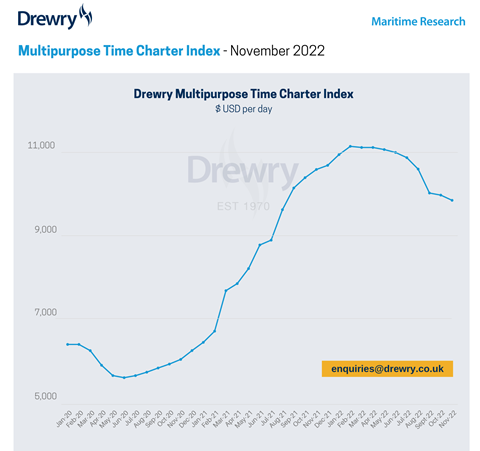

Drewry’s November Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index continued to decline over October. However, the pace of that decline has slowed.

Rates in October averaged at around USD10,025 per day. The shortsea spot market steadied, underpinned somewhat by increases in bunker prices and the need for cargo to be cleared before the year end. Meanwhile, the project cargo sector is still benefiting from forward contracts for both wind power and oil and gas, the latter on the back of strong oil prices.

Any decline in rates, the analyst added, is largely driven by increased capacity and pressure from the container sector.

It expects that falling container rates will continue to add pressure during November, bringing the index down by a further 1 percent to reach around USD9,900 per day – a decrease of 12 percent from the peak of the market and 7 percent down from November 2021. Nevertheless, that figure still remains 63 percent ahead of November 2020.

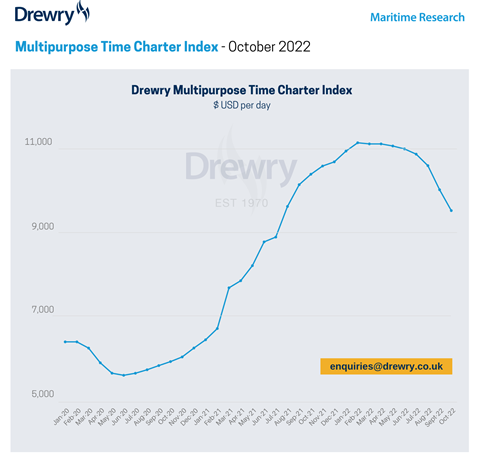

Drewry’s October Multipurpose Time Charter Index

The Drewry Multipurpose Time Charter Index continued its decline in September at a much faster rate than previously predicted.

Spot rates in both the container and bulk sectors lost between 10-30 percent of their value over the month, taking multipurpose charter rates down with them. Drewry estimates the latter to have fallen by some 5.4 percent during the month, taking the index to an average USD10,075 per day.

“Our prediction for October is more of the same, with increasing global uncertainty. Small shifts in demand will weaken the market further, with the index likely to decline by a further 5 percent over the coming month,” said the analyst.

There has been a sharp slump in competing sectors. Over September, handysize bulk rates softened as tonnage availability increased, while container rates practically fell off the cliff having lost in excess of 30 percent of their value, said Drewry. Congestion is easing, although there are still pockets of disruption internationally, and bunker prices have declines. Drewry noted that while rates are still at historically high levels, a realignment has begun in earnest as container lines assess their utilisation and demand weakens with rising concerns about inflation, energy prices and geopolitical uncertainty.

Going forward, Drewry expects rates to continue to weaken, although they will remain well above the market levels of 2020. “The rising risk of recession in a number of developed countries, high inflation in the USA and the slowing housing market in China are all adding to the increasing uncertainty for this sector. The main positive on the horizon is renewables cargoes, particularly for wind energy. But this is very niche, for heavy lift capable vessels only, so will not be enough to stem the downward trend,” said the analyst.

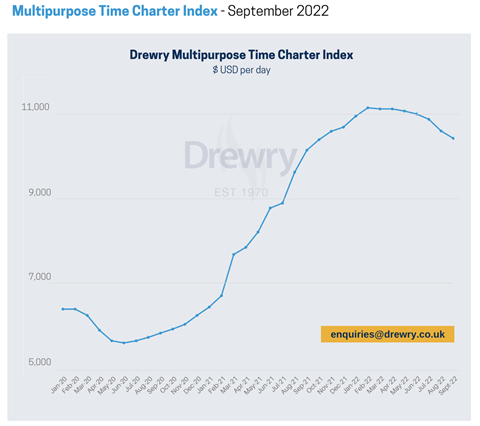

Drewry’s September Multipurpose Time Charter Index

The index averaged USD10,650 per day over the month, a drop of 2.5 percent compared to July. The analyst said: “The drop is mainly attributed to a much quieter summer than expected, with shippers still adopting a wait and see policy – no-one wants to fix whilst the market is dropping.

“Couple that with political and economic uncertainties and an inflated market and a further decrease is almost inevitable into September. Our current prediction is for our multipurpose index to decline a further 1.6 percent over the coming month.”

Over August 2022, both the bulk and container spot markets have reported increasingly negative sentiment as demand weakened, while capacity levels remained steady.

It added: “For the multipurpose sector, Asia remains a hot spot with much of the weakness in the Atlantic region. Increasing concerns regarding US inflation, European recession and global energy prices have reduced consumer confidence, although again this sector is slightly behind the curve as energy and mining cargoes remain steady.

“Going forward we expect to see rates continue to decline, albeit they are still at historically high levels, but the potential pick up after the holidays may slow that decline slightly.”

Previous Drewry Multipurpose Time Charter Index data

Published August 10, 2022: The Drewry Multipurpose Time Charter Index fell slightly over the course of July to USD10,925 per day.

The 1.1 percent slip over June 2022 was attributed to global uncertainty about the economy, with operators hesitant to commit to long-term charters at current high levels. The shipping analyst expects the rate to drop 0.7 percent over the summer to USD10,850 per day.

“The increasing worries about inflation in Europe and the USA coupled with China’s response to Nancy Pelosi’s visit to Taiwan, has meant that macroeconomic uncertainty remains one of the bigger drivers for this sector. At the same time Handy [size bulker] spot rates and the smaller container vessels saw charter rates continue to fall over July, as activity levels fell as the European holiday season started,” said the analyst

Drewry added that for the smaller, mainly shortsea fleet, activity levels were more in line with a “normal summer market” with noticeably fewer cargoes available over the month and more vessels open.

For the larger vessels, with more heavy lift capability, there remains a good level of optimism for renewables cargoes, but here too the spot market started to wane as time charter period lengths started to decrease.

July 8, 2022: The Drewry Multipurpose Time Charter Index weakened slightly over June, by just 0.6 percent, to USD11,050 per day.

In May 2022, Drewry’s rate stood at USD11,120 per day. The marginal decline was attributed to softening spot rates in competing shipping sectors. “Going forward we expect the weakening trend to continue in July, albeit very slowly, with rates dropping a further 1.4 percent, to USD10,900 per day,” said Drewry.

It also drew attention to market uncertainty. “Chinese exports are still hampered by covid restrictions, European demand is weak due to increasing economic concerns and inflation in the US coupled with the continue supply chain issues at the major ports mean that consumer confidence is receding fast,” said the analyst.

“On the multipurpose charter market, the shortsea sector is becalmed with rates over much of June steady in the face of rising fuel costs and continued conflict in Ukraine (and what that means in terms of vessel supply and certain trade lanes). Add to this the inevitable summer slowdown that this smaller sector faces (as steel mills close for the holidays and harvests are not quite ready) and there is some space in the sector in the short term.

“For the larger, more heavy lift capable sector rates have weakened in line with the weakness in the container sector. That said, we don’t expect this softening to quicken, with only a very gradual decline expected over the summer as the capacity issues start to unwind slowly on some routes.”