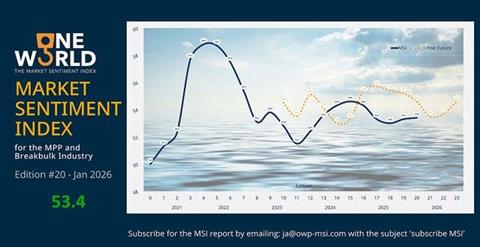

The 20th edition of the Market Sentiment Index (MSI) for the MPP and Breakbulk Industry shows a third successive – albeit modest – rise to a level of 53.4.

The report finds that short-term cargo volumes have modestly improved and longer-term expectations remain positive. Europe is increasingly operating on a near-spot basis, while in Asia bookings are being made several weeks in advance as project and breakbulk cargo emerges faster than vessel capacity returns from extended Cape of Good Hope routings.

However, as Suez Canal and Red Sea transits begin to reopen, voyage turnaround times are set to shorten. With ships returning to Asian loading areas more frequently, there is potential to dampen premiums.

One World Shipbrokers’ Justin Archard, author of the report, points out that the MPP sector enjoyed a rare period of relative stability in 2025, despite the geopolitical turbulence resulting from the first year of US president Donald Trump’s second term in office.

“Time charter rates remain high enough to reward owners of current stock but are not high enough to encourage speculators. Newbuilding orders for relatively conventional MPPs have been creeping up but are still comfortably within a 1:1 replacement ratio,” he said.

However, the wider discussion circles around the large newbuilding order placed by COSCO last year. While it remains to be seen how these large MPPs on order will be traded, they do have the potential to increase supply to heights the market would find difficult to absorb if current trading conditions prevail.

The MPP sector entered 2026 in a balanced and resilient position. “Forecasts made 12 months ago for improving market conditions have proven demonstrably correct, even inside the maelstrom of uncertainty,” said Archard. He said the market maintains a positive outlook for the year ahead.

The outlook for edition #21, due for publication at the end of April, points to a further modest increase in sentiment.