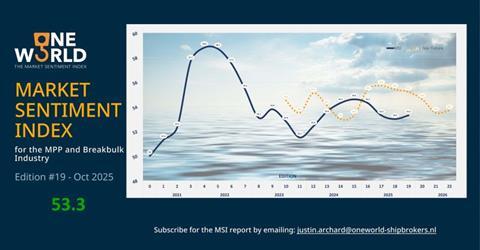

The mood about the multipurpose and breakbulk shipping industry has risen modestly, according to the 19th edition of OneWorld Market Sentiment Index (MSI).

The MSI saw a modest rise for the first time in 2025 to a level of 53.3. Of the 27 carriers that provided input to the poll, 40 percent polled higher, 48 percent polled lower, with 12 percent either unchanged or participating for the first time.

Mirroring a similar split in the 18th edition of the MSI, carriers remain uncertain of the trading environment directly ahead. “The combination of frequently changing regulations in the USA together with increasingly arbitrary power in policy making, carriers are wedged between a short-term market which is sitting on its hands hoping a full-blown trade war does not erupt, and a longer-term market that is offering increasing demand from project cargos,” said the analyst.

The report highlights that whilst multipurpose vessels are broadly shielded from some of the main drags and drivers in the general shipping industry, such as the recently implemented USTR port fees for Chinese built and/or operated vessels, sentiment is affected by wider geopolitical pressures.

For instance, offshore wind energy projects in the USA are struggling and several European lease auctions failed to attract any bidders over the summer.

“The Gaza ceasefire is welcomed by everyone, but carriers will now be wondering when there will be a return to Red Sea transits which, welcome as it may be, will significantly increase nominal capacity, add pressure to freight rates and disrupt trading patterns once again,” said the analyst.

Heading into the final months of the year, Q4 is often a very positive period, although carriers note that the lift has yet to arrive. The northern summer 2025 season passed off as stable, to the relief of many, and the Toepfer Multipurpose Index (TMI) remains solid and range bound confirming what has been evolving for much of 2025; that for now there is a status quo between supply and demand.

The analyst believes that hopes for 2026 will rest on an easing of the trade war so that manufacturing and supply chains can again begin to invest in a trade environment of consistency and continuity. The 20th edition of the MSI will be published in January 2026.