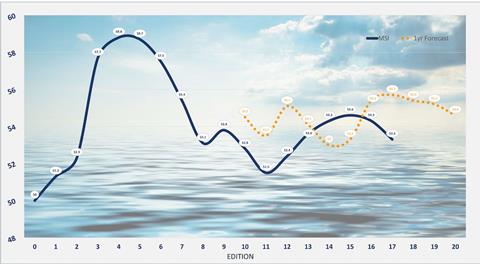

The 17th edition of One World’s Market Sentiment Index (MSI) reveals another dip in industry confidence, falling to 53.3 amid tariff turmoil, transpacific trade contraction, and energy project setbacks. Yet with most multipurpose tonnage still fully employed some see a sector better positioned to endure volatility than in years past.

The latest edition of the Market Sentiment Index (MSI) for the multipurpose and breakbulk industry showed further slippage in sentiment, failing from 54.3 in Q1 2024 to 53.3 today.

The analyst explained that at the time of polling, US president Donald Trump had just announced the most punitive tariffs regime the world has ever seen followed swiftly by a moratorium on most of them, once equity and bond markets went into convulsions. “Nothing stops investment and growth like uncertainty and much of the business world is now sitting on its hands waiting for the situation to play out,” it said.

Moreover, at the time of polling, the US Trade Representative’s (USTR) decision on exercising exorbitant port charges on Chinese built and/or operated tonnage was not known. “Now that we know, all but a few MPP carriers will be exempted and the relief is palpable,” it said.

The analyst noted, citing Mark Szakonyi of S&P Global (speaking at April’s JOC Breakbulk & Project Cargo conference), a roughly 40 percent collapse in trans-pacific cargo volumes imported into North America during April. May is predicted to be equally bad. “Following the spike that preceded it as businesses front loaded inventory ahead of tariffs in the early part of the year, the Q1 negative GDP print released in recent days is likely to be followed by a sharp GDP spike in Q2 as exports beat imports,” said the analyst. “This of course will be eyed for what it is and cloud further the actual impact on trade.”

The analyst added that the multipurpose community waits to see whether long approved renewables projects in North America will go the way of Empire Wind 1, further denting a wind energy market that has struggled to deliver all that it has promised in recent years. “But now, with energy independence and security top of governmental concerns around the world, the developing world’s rising need for energy infrastructure will, over time, support and expand multipurpose shipping’s operating footprint.”

Despite all the uncertainty however, the analyst said that the multipurpose fleet remains essentially fully employed, with both freight and time charter rates sitting at healthy and sustainable levels. It added that although the multipurpose sale and purchase market is currently struggling to complete any transactions owing to unbridgeable spans on vessel values between buyers and sellers, quality tonnage is achieving healthy levels on the commercial charter market offering owners a viable alternative to selling.

“So, in contrast to the last 10 years, the multipurpose market is currently more or less in balance and with newbuilding orders only likely to increase the number of operating vessels by a net 1.5 percent per year until 2029, according to S&P Global data, the multipurpose sector looks well placed to weather any extended uncertainty and capitalise on any increase in activity,” said the analyst.

Looking ahead, the report notes that carriers still expect the market to be in a stronger position in a year’s time. “However, as we have seen in recent polls, confidence in the future market environment has waned over the last three editions. Resolutions to both the Gaza and Ukraine wars do not look likely in the near term and the return of shipping through the Red Sea is not yet visible,” the analyst cautioned. “Cross trade predation on the liner port pairs could become more competitive as container carriers seek to plug missing volumes on their expanding fleets by tapping further into breakbulk. As we head into the often patchy summer months for the multipurpose fleet, one question that several carriers were heard discussing in New Orleans was whether the result of the US-led economic disruption could lead to another post pandemic-like boom?”

Regional sentiment averages

Despite the ongoing turmoil, both European and American carriers in these markets polled higher than the MSI average in this edition. This offset near term malaise among Asia carriers.

In terms of the one-year outlook, the analyst said sentiment in the Americas is in relative free-fall, whilst Asian carriers have a more positive longer term outlook.

“Whilst Asian carriers are generally more positive in the year ahead, all eyes will be on whether Trump’s policies will damage what has been a positive pipeline of US projects. With offshore wind already reeling from Empire Wind 1 being shut down, Saturday’s announcement from OPEC+ to increase oil supply from June will add downward pressure to an oil price already low enough to be nudging at the incentive price for oil and gas project developers and potentially hindering new project FIDs,” said the analyst. Nevertheless, whilst the continuing threat of Houthi strikes in the Red Sea continues, the multipurpose fleet – particularly the European intercontinental deepsea carriers – will continue to benefit from the longer voyages, said the MSI.

It added: “Recent indicators show the potential for a softening in Trump’s tariff position as the institutional safeguards in the USA have started to kick in as the bulwarks they were designed to be. The US Treasuries yield scare was very probably a turning point and the S&P 500 has since started to recover some of its losses. Before the next edition of the MSI, full implementation of the proposed tariffs are scheduled to be enacted.

“Were Trump to press ahead, the chance of a worldwide recession significantly increases according to economists, reversing growth, curtailing investment and fuelling negative sentiment. The current consensus across the business and investment world is that Trump will – eventually – pull back from the brink,” said the analyst.