The 2024 Emerging Markets Logistics Index, curated by Agility and Transport Intelligence, suggest that logistics executives are still worried about a global economic recession, are battling higher costs, and many plan to boost investments in Africa.

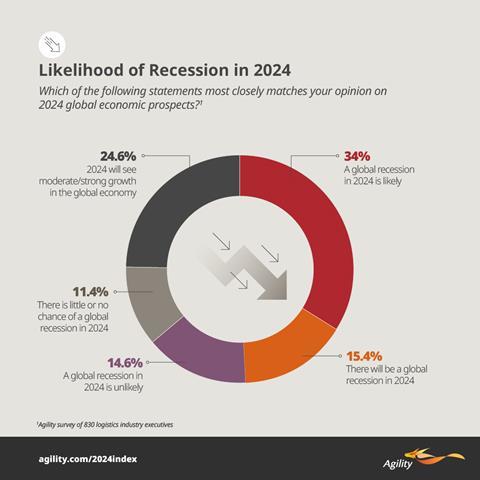

Half of the 830 industry professionals surveyed for the 2024 index expect a global recession in the coming year – down from nearly 70 percent a year ago. 63 percent of respondents say their companies continue overhauling supply chains by spreading production to multiple locations or relocating it to home markets and nearby countries. China, the world’s leading producer, stands to be most affected: 37.4 percent of industry professionals said they plan to move production/sourcing out of China or reduce investment there.

Moreover, the logistics industry is gearing up for a surge in investment in Africa, despite its higher risk profile. Nearly 62 percent of professionals said their companies are planning additional or first-time investments in Africa vs. only about 7 percent exiting or scaling back there.

China and India retained their spots at number one and two in the overall rankings. However, the gap between these two countries is much smaller compared to previous years, with just 0.6 percent separating their economic growth projections. Outside of the top 10, many of the biggest swings in year-to-year rankings involved countries experiencing conflict, facing international economic sanctions, or suffering from chronic economic instability. Among them: Ukraine, Russia, Iran, Ethiopia, Argentina, Lebanon, Tunisia.

In terms of economic diversification, the survey finds that Saudi Arabia has seen the most progress over the past decade, followed by the UAE and Qatar. As a result of a new set of laws in Saudi Arabia to promote entrepreneurship and reduce the costs of doing business, new investment deals and licenses grew by 95 percent and 267 percent in 2022 respectively.

Renewable electricity is growing at a faster rate in India than any other major economy, with capacity additions on track to double by 2026. The country is also one of the world’s largest producers of modern bioenergy and has major ambitions to scale up use. Moreover, India could overtake Canada and China in the next few years to become the third-largest ethanol market worldwide after the USA and Brazil.

According to the index, ‘reducing energy consumption’, ‘waste reduction/recycling’ and ‘increasing the use of renewables as a percent of our energy consumption’ are the three most common sustainability initiatives that companies plan to undertake as part of their 2024 priorities in emerging markets.

“The 15th edition of our annual Agility Emerging Markets Logistics Index is sobering. It contains a number of important cautions for those who invest in and care about the world’s developing economies,” said Tarek Sultan, vice chairman of Agility. “Taken together, the data and our survey of 830 logistics industry executives represent flashing warning lights about the fragile state of the global economy, ongoing trade fragmentation, and emerging markets debt, among other issues.”

He added that the results of the 2024 index signal that global trade and the World Trade Organization (WTO) are at a crossroads as companies struggle to harden their supply chains through near-shoring, re-shoring, friend-shoring and other production/sourcing strategies.

He said that when WTO ministers meet in February in Abu Dhabi, the agenda will include negotiations on e-commerce rules and subsidies for grain and fisheries. “Those issues mask deeper fundamental divisions about the overall direction of global trade, the viability of current rules and dispute resolution mechanisms, and the possibility that the supply chain de-risking we are witnessing becomes a de-coupling of the world’s largest economies and a split along East-West lines,” said Sultan, adding that “de-coupling and the fragmentation of global trade would be a disaster for emerging markets countries. They will feel pressure to pick sides if China, the USA, the EU and India can’t rebuild trust and work through sharp disagreements about big issues.”