Despite an increase in spending on conventional oil and gas exploration, the industry is witnessing a concerning trend – a significant drop in discovered volumes.

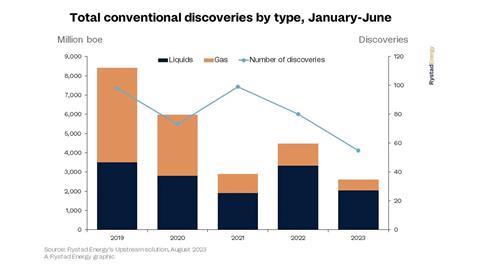

Research conducted by Rystad Energy indicates that explorers found 2.6 billion barrels of oil equivalent (boe) in the first half of 2023, a 42 percent decrease over the same period in 2022 in which 4.5 billion boe was found. 55 discoveries have been made, compared to 80 in the first six months of last year.

The exploration and production (E&P) sector is in transition, with many companies becoming cautious and redirecting their strategies towards geologically favourable and profitable regions. This shift, combined with the failure of several high-potential wells, has led to a sharp decline in discovered resources.

In terms of locating new resources the offshore sector has been prioritised, aiming to capitalise on underexplored or frontier areas where high-risk, higher-cost offshore developments could unlock new volumes. Despite accounting for about 95 percent of exploration spending in 2023, the offshore industry has only contributed to about two-thirds of the total discovered volumes.

While upstream companies strive to meet the increasing demand for fossil fuels and find additional resources, the recent lacklustre results are cause for concern, according to Rystad. If exploration efforts continue to disappoint for the rest of the year, 2023 may go down as a record-breaking year for all the wrong reasons.

Guyana’s Stabroek offshore block leads the pack in terms of discovered volumes with 603 million boe in 2023. Türkiye, Nigeria, and Namibia follow with significant volumes as well, with the potential for these numbers to grow as the reserves are better understood.

The analysis also highlights the disappointment in high-impact wells, with only four out of 13 completed wells encountering hydrocarbons. 31 in total are expected to be completed this year.

In terms of spending, the six major companies – ExxonMobil, BP, Shell, TotalEnergies, Eni, and Chevron – continue to play a crucial role in global exploration. They are projected to spend about USD7 billion on exploration in 2023, a 10 percent increase from the previous year.

The second half of 2023 is expected to see a boost in exploration activity, with several critical exploration wells planned to be drilled. The majors are anticipated to contribute significantly to global exploration spending in the coming months, especially in the offshore sector and frontier regions. Rystad said the majors will contribute about 14 percent of total global exploration spending in the coming months.

National oil companies (NOC) hold the largest subsurface resource base at their disposal and are expected to account for more than half of the projected exploration spending in 2023, including NOCs with international portfolios (INOC).

While 2023 has been challenging, there is hope that the remaining activity in the year could still yield some successful discoveries. Only 30 percent of the anticipated wells have been completed so far, leaving a significant number yet to be drilled or postponed until 2024.