While some container shipping lines have begun to test the waters with Red Sea and Suez Canal transits, One World’s latest Market Sentiment Index (MSI) finds that breakbulk and project cargo shippers, for the most part, are not ready to take the risk.

Total Suez Canal transits trended upwards in 2025 but still remain 50 percent lower than they were in late 2023. In the third week of 2026, Maersk piloted a return with the resumption of its MECL service via the Suez Canal, opening the way for others to follow.

HLPFI reported in December 2025 that multipurpose and heavy lift carriers had adopted a wait and see approach. BBC Chartering, for instance, said a return to the area could happen at short notice if safety could be assured.

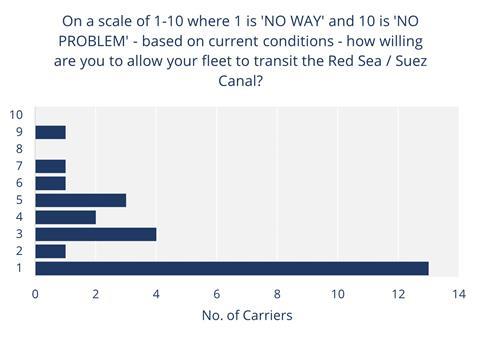

The Q1 2026 edition of the MSI asked 26 MPP carriers whether they are willing to send their vessels through the Suez Canal. The feedback was clear: not yet.

Carriers were asked: “On a scale of 1–10, where 1 is ‘no way and 10 is ‘no problem’, how willing are you, based on current conditions, to allow your fleet to transit the Red Sea/Suez Canal?”

Half of all respondents selected ‘No way’. Only three of the 26 carriers surveyed scored above five, no respondent chose 10, and the average score across the sample was just 2.8.

The split between tramp and semi-liner operators was broadly even at the most risk-averse end of the scale. Those showing a greater willingness to contemplate a Suez transit were predominantly semi-liner operators, typically operating higher deadweight tonnage vessels.

If confidence about Suez Canal and Red Sea transits improves and carriers return to the area, voyage turnaround times would shorten. With ships returning to Asian loading areas more frequently, there is potential to dampen premiums. However, there are other factors that will influence a return of MPP and heavy lift carriers to the area.

One contributor to the MSI said that a return hinges on securing broad shipper acceptance across multi-shipper voyages, and that getting everyone aligned is proving “a challenge”.